Tackling the financial risks of the future

Practical solutions powered by cutting-edge technology to support your operations

The Three Core Pillars of Our Platform

Our platform has earned strong trust from major Japanese financial institutions, supported by three core pillars: balancing operational efficiency and security, complete transparency in calculation logic, and dedicated support from experts. This unique combination offers a highly reliable solution that customers can confidently use for financial risk management operations.

In traditional on-premises environments, customers had to handle infrastructure setup, application configuration, monitoring, and maintenance themselves, creating a significant operational burden. With NtSaaS, we take full responsibility for these operations, allowing customers to focus on their core business. Additionally, as a fully managed service, we enhance operational efficiency and continuously strengthen security through regular updates and monitoring.

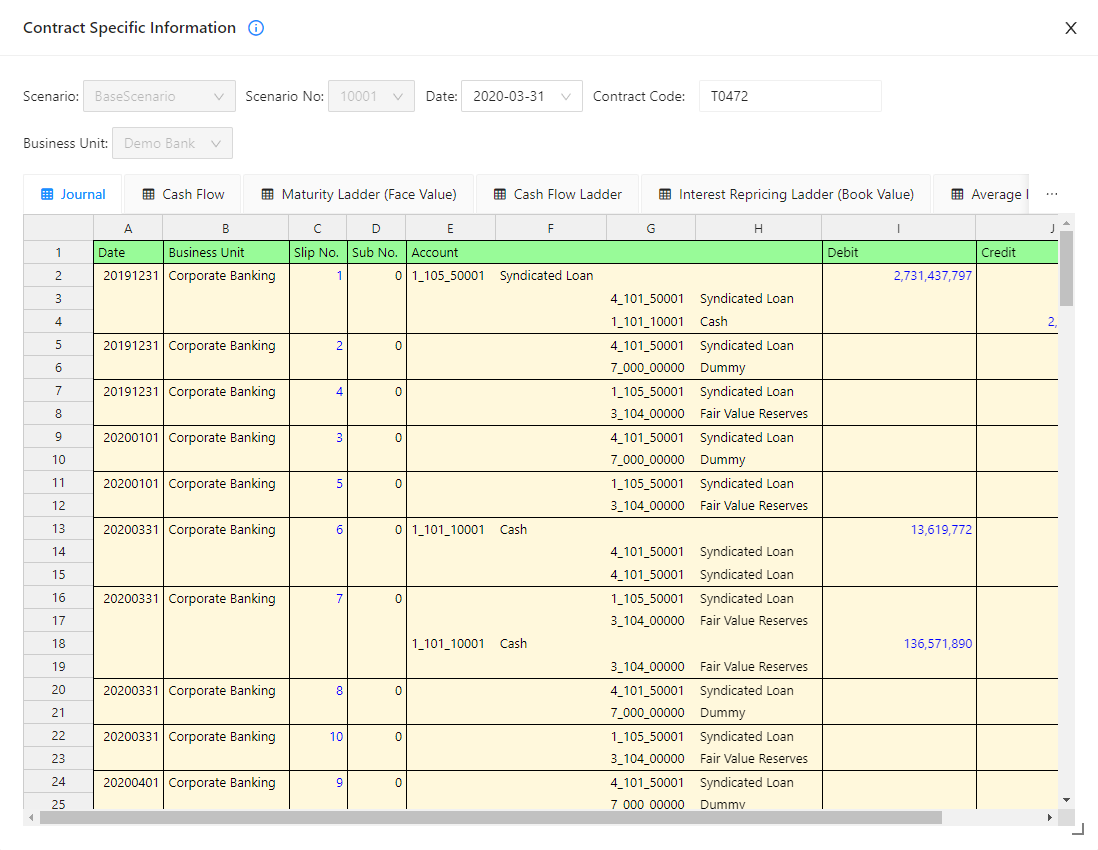

We ensure high explainability and complete transparency in our calculation logic. All results output by NtSaaS are derived from verifiable logic, making them highly reliable and audit-ready. This rigorous, consistent approach allows customers to verify result validity themselves, strengthening trust in transparency and enabling more advanced and precise risk management.

Our services are supported by experienced engineers who have long supported major financial institutions. Their deep expertise goes beyond technical assistance, addressing each customer's unique challenges and fostering a true partnership aimed at long-term success.

Architecture Optimized for Financial Risk Measurement

NtSaaS is a secure and scalable SaaS platform equipped with the accuracy, speed, and reliability demanded in financial risk management operations.

Its robust architecture combines our proprietary high-performance computing engine with cutting-edge cloud technology, enabling fast and reliable processing of large-scale, complex financial computations. With transparency and reproducibility of models ensured, the platform supports daily risk analysis, stress testing, and scenario analysis.

Protecting Your Data with Robust Security Design

NtSaaS provides a multi-layered security architecture that comprehensively protects everything from the infrastructure layer to applications and user operations, built on a SaaS platform trusted and adopted by major financial institutions.

With robust access controls, real-time threat detection, high-level encryption (in transit and at rest), and strict audit trail management as standard, we maintain a proactive security posture against increasingly sophisticated cyber threats.

These security features are integrated throughout the platform, allowing users to focus on critical risk analysis and management without concern for security. Experience a secure and dependable environment that is already in production at many major financial institutions.

Proactive Managed Operations by Technical Experts

From routine maintenance and software updates to optimizing complex system configurations and advanced monitoring for early failure detection, our experienced technical experts handle everything. Customers can focus on their core business without the burden of infrastructure operations or security concerns.

Leveraging cloud-based managed services, we not only simplify operations but also greatly enhance resilience against rapidly evolving cyber threats. Recognized as a 'strategic IT investment,' this approach simultaneously reduces risk and improves availability — earning high trust from many clients.

This service is built on a robust architecture that meets strict security requirements, ensuring both data protection and operational reliability. Our comprehensive managed services include:

Services Provided

VaR Calculation and Asset Liability Management

Banks

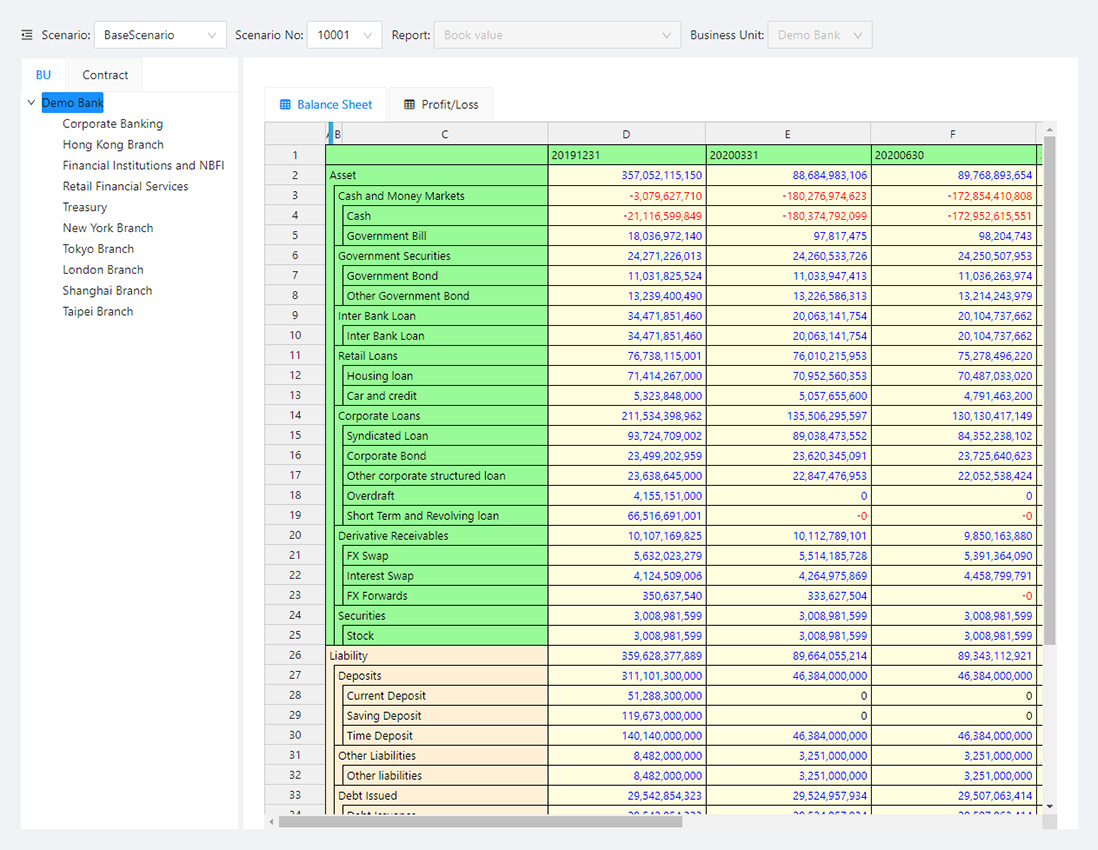

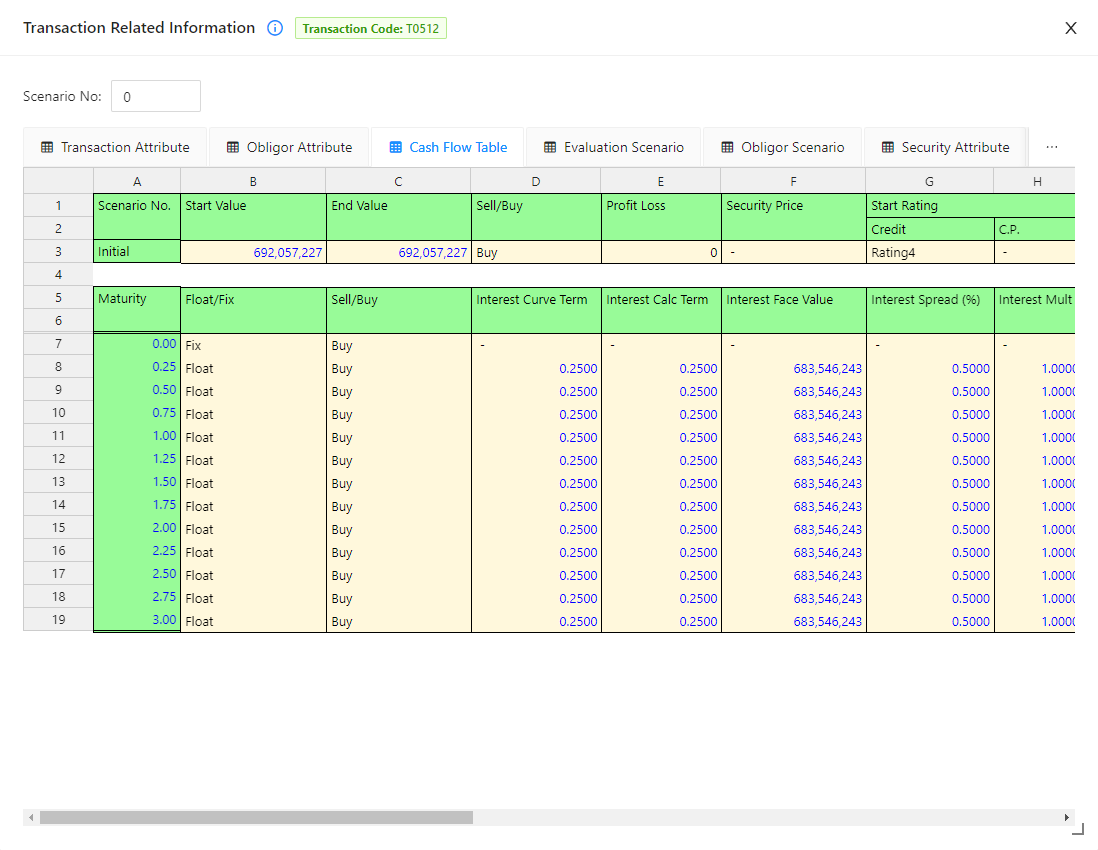

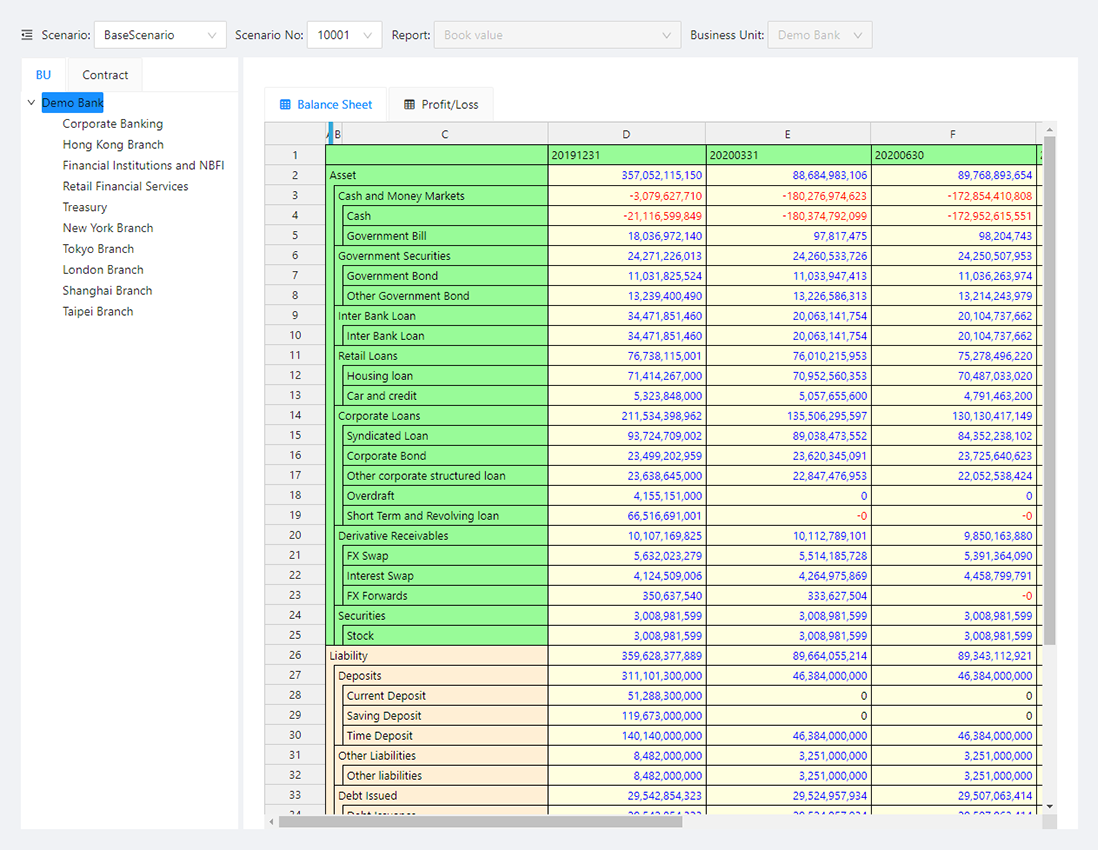

With an eye toward enhancing interest rate risk management, including IRRBB, we provide a solution that enables multifaceted and advanced analysis related to ALM.

In addition to conventional indicators such as BPV, it supports the calculation of ΔEVE, which represents changes in economic value under interest rate shocks, and ΔNII, which evaluates period-based earnings.

It also enables flexible integration with interest rate scenarios, including standard interest rate shocks and planning scenarios.

Insurance

With an eye toward enhancing ERM (Enterprise Risk Management), we provide a solution that enables a wide range of analyses—from company-wide business planning to asset management strategies.

As a company-wide simulation platform, it calculates future B/S (under current accounting and fair value basis) and P/L, incorporating not only assets but also insurance liability cash flows output from actuarial systems. It also supports the calculation of various KPIs and KRIs required in the PDCA cycle.

For economic environment scenarios, it enables flexible integration with deterministic scenarios and others, providing multifaceted support from strategy formulation to risk assessment.

Banks

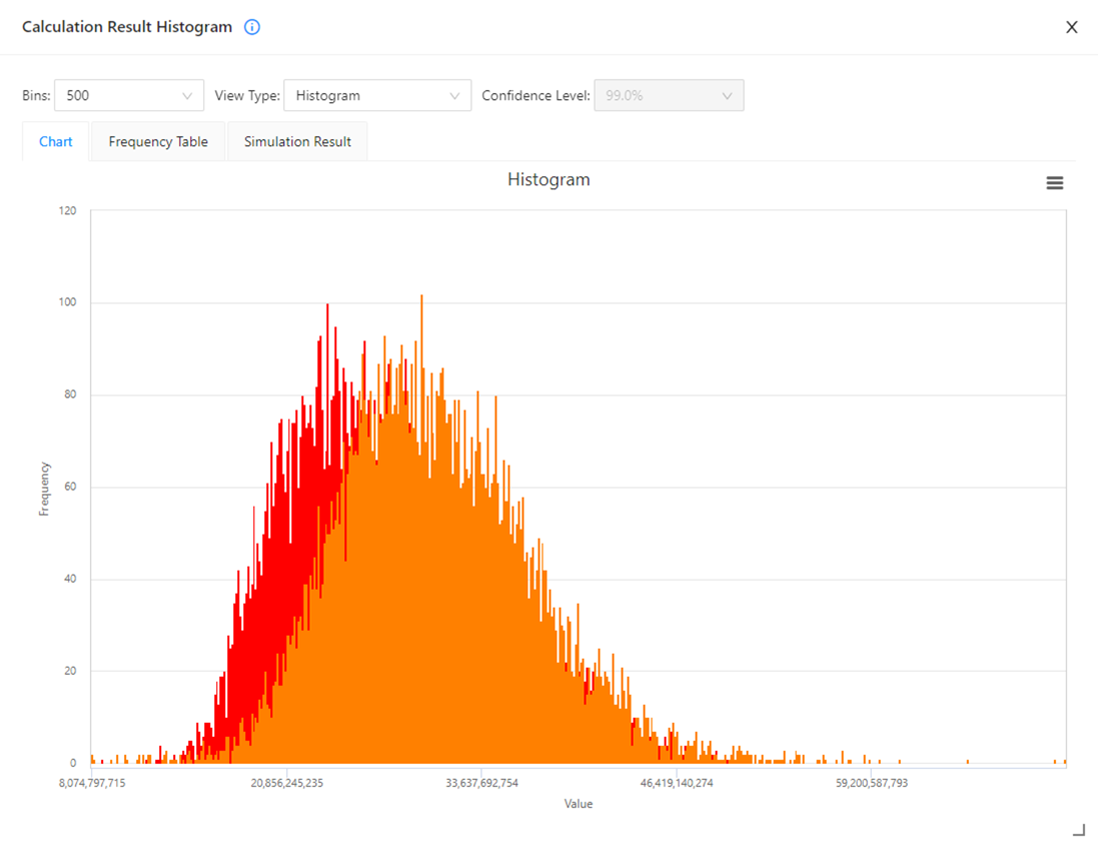

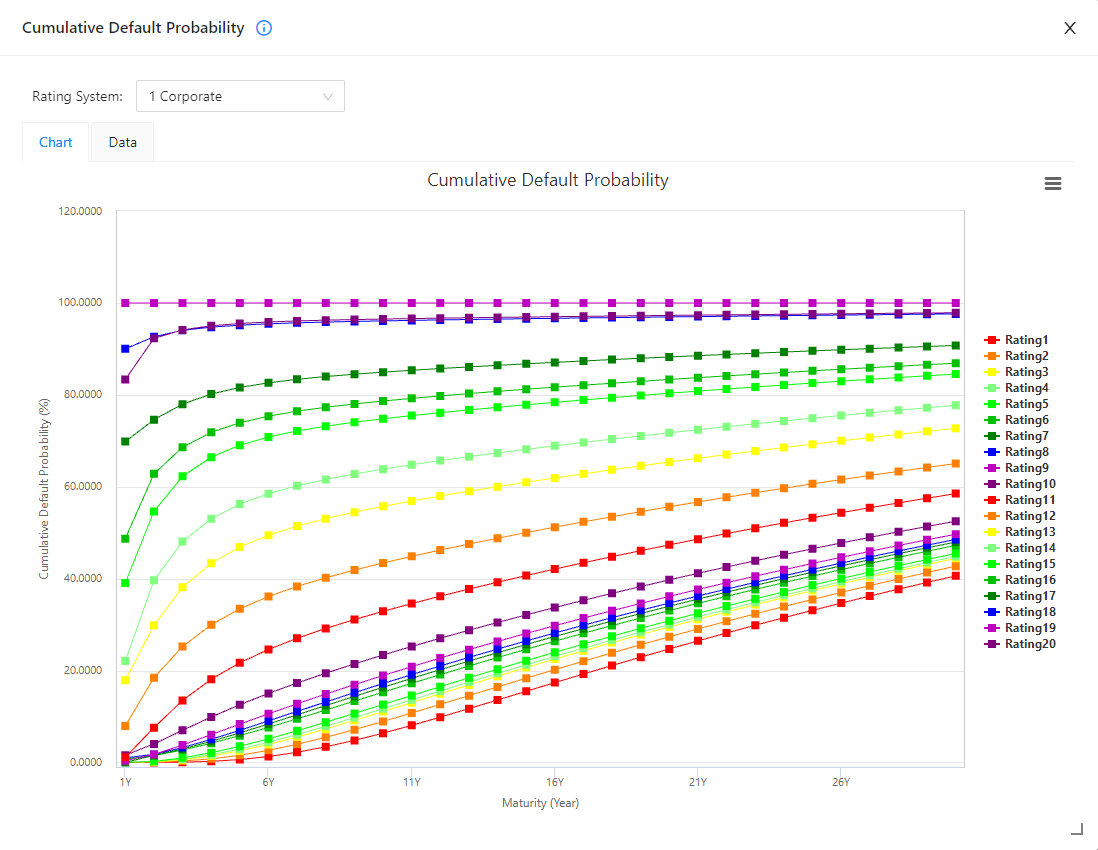

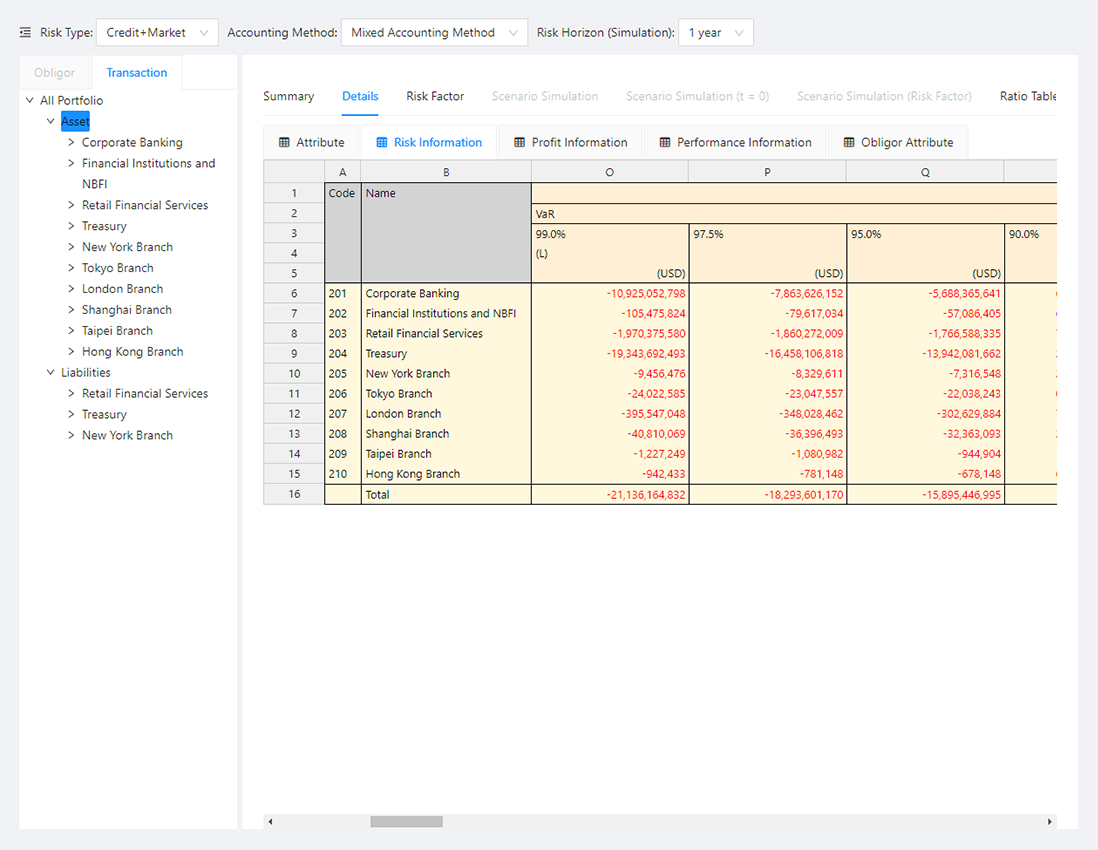

Amid increasing market volatility and a growing trend toward more advanced risk management, there is a rising demand for greater precision and sophistication in internal models.

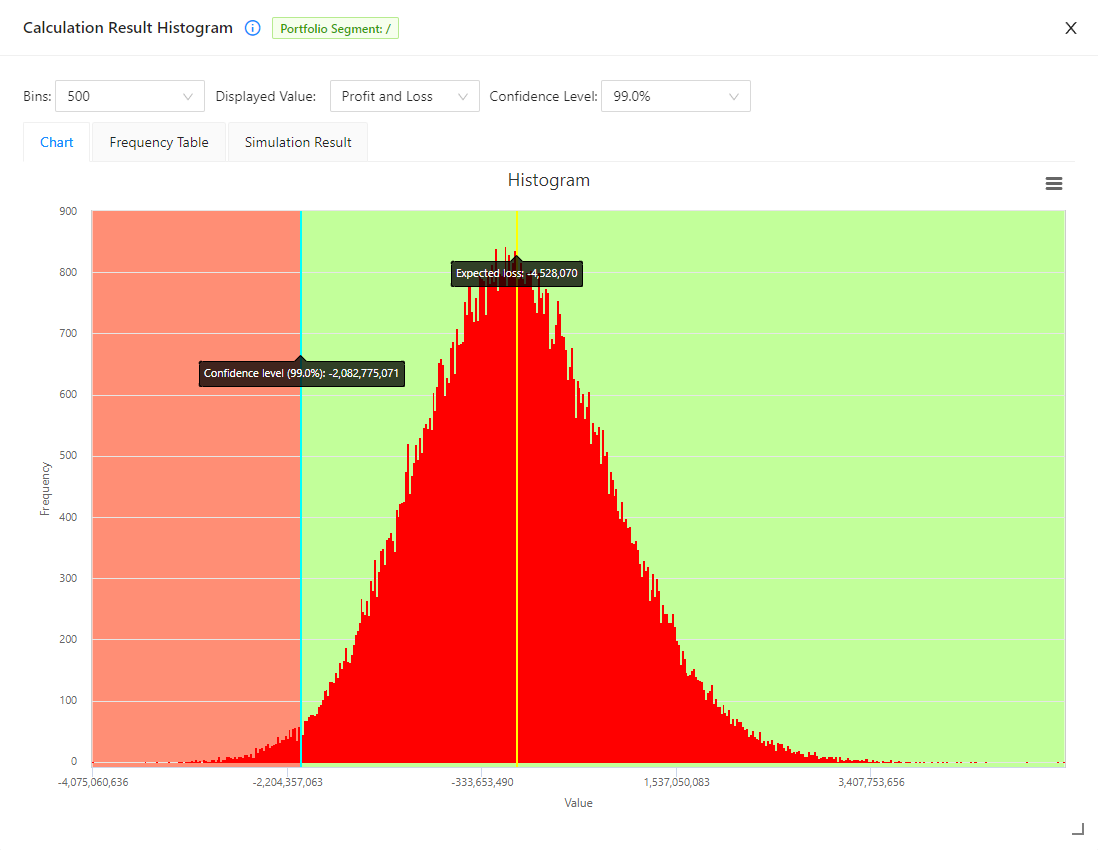

For market risk measurement, the platform supports both the historical method and Monte Carlo simulation, enabling the calculation of ES (Expected Shortfall) in addition to traditional VaR. Furthermore, OLAP functionality allows for highly accurate and flexible drill-down analysis at the trading desk level.

For credit risk measurement, models with strong alignment to Basel regulations are implemented, supporting both regulatory compliance and advanced risk management.

Insurance

Against the backdrop of economic value-based solvency regulations, adoption is increasing among many insurance companies.

We provide advanced solutions that enable the measurement and analysis of market, credit, and integrated risks for assessing current and future risks in ORSA.

For market risk measurement, the platform supports integration with shock and stress scenarios, enabling precise evaluations that account for diverse economic environments and market fluctuations.

Technique

Random Number Generation

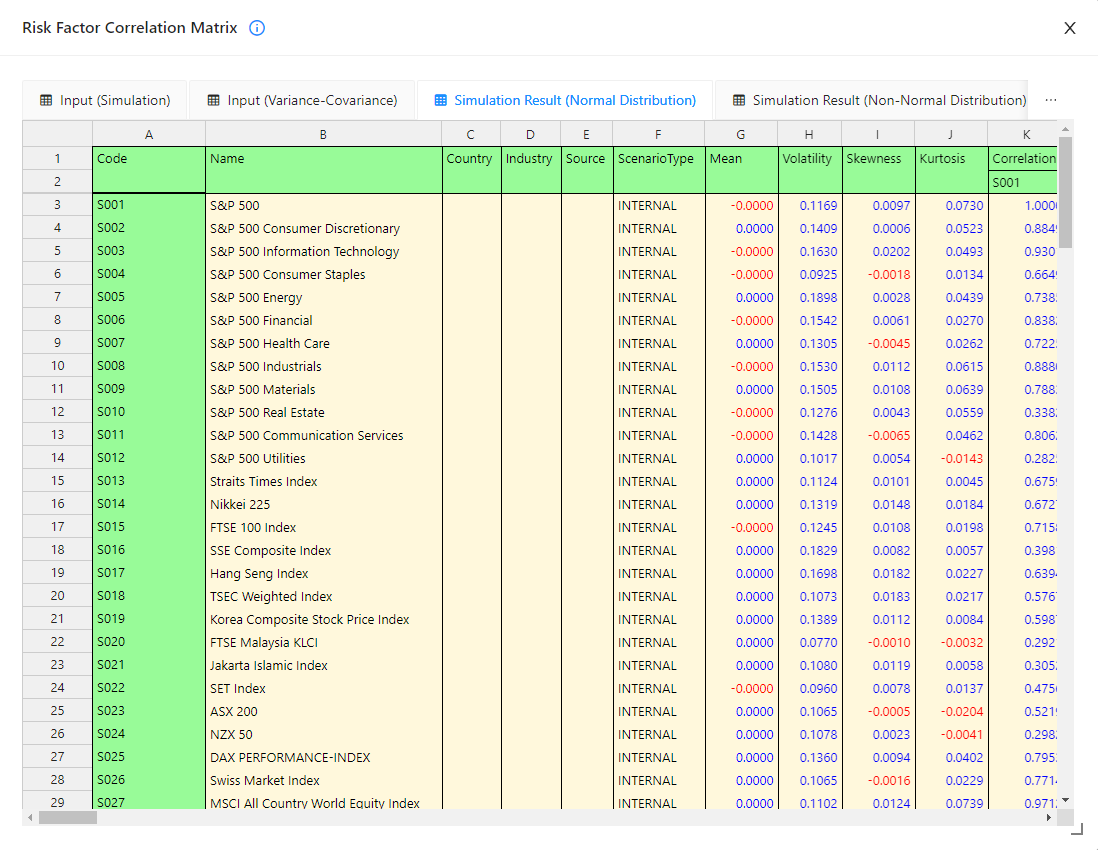

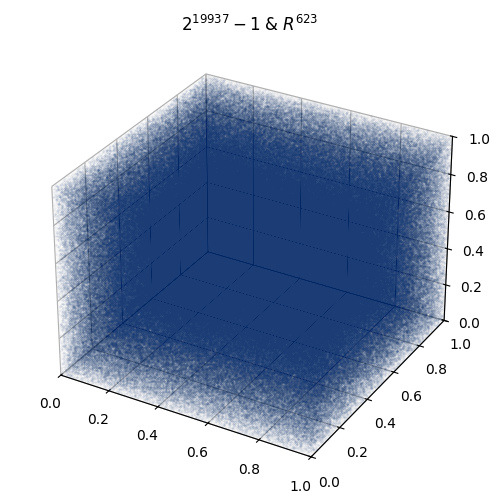

A high-quality pseudo-random number generator (RNG) is important in financial risk management because the simulation of an entire financial institution’s portfolio requires a huge set of random numbers.

One such high-quality pseudo-RNG is Mersenne Twister. Developed by Professor Makoto Matsumoto in 1997, Mersenne Twister has become today’s de facto standard in high-quality pseudo-RNG.

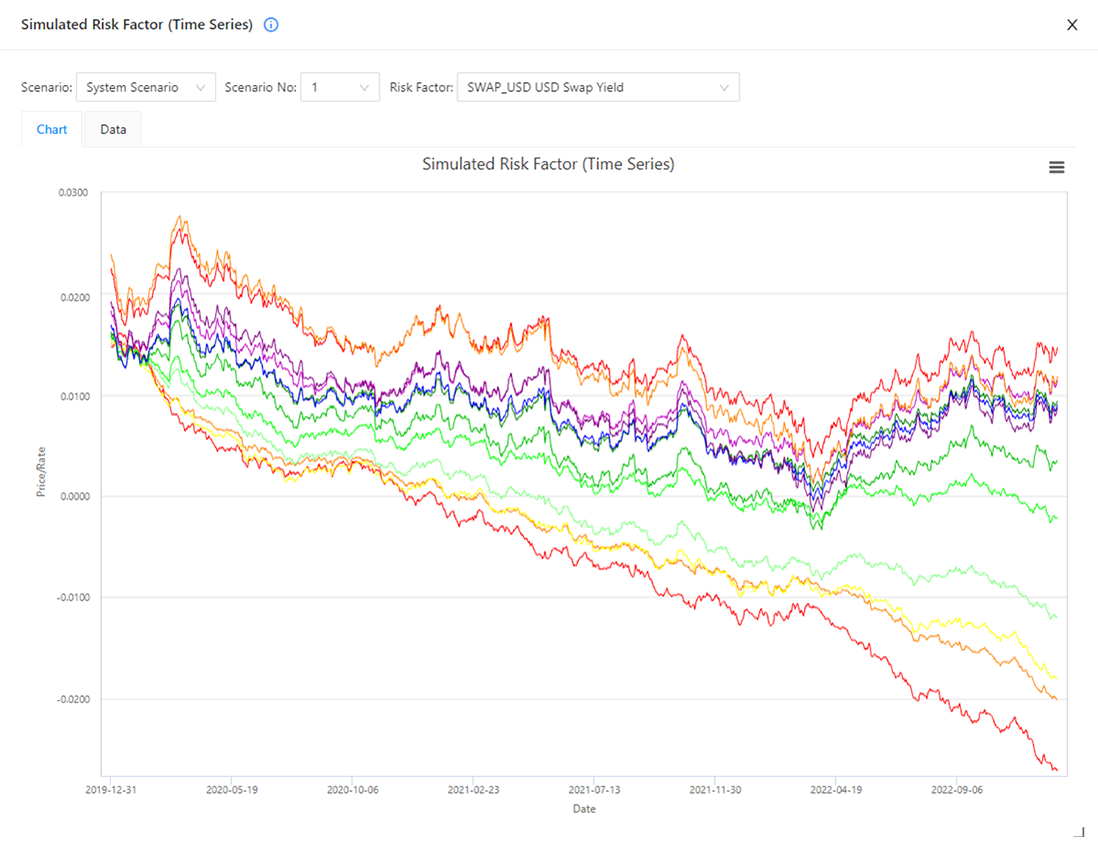

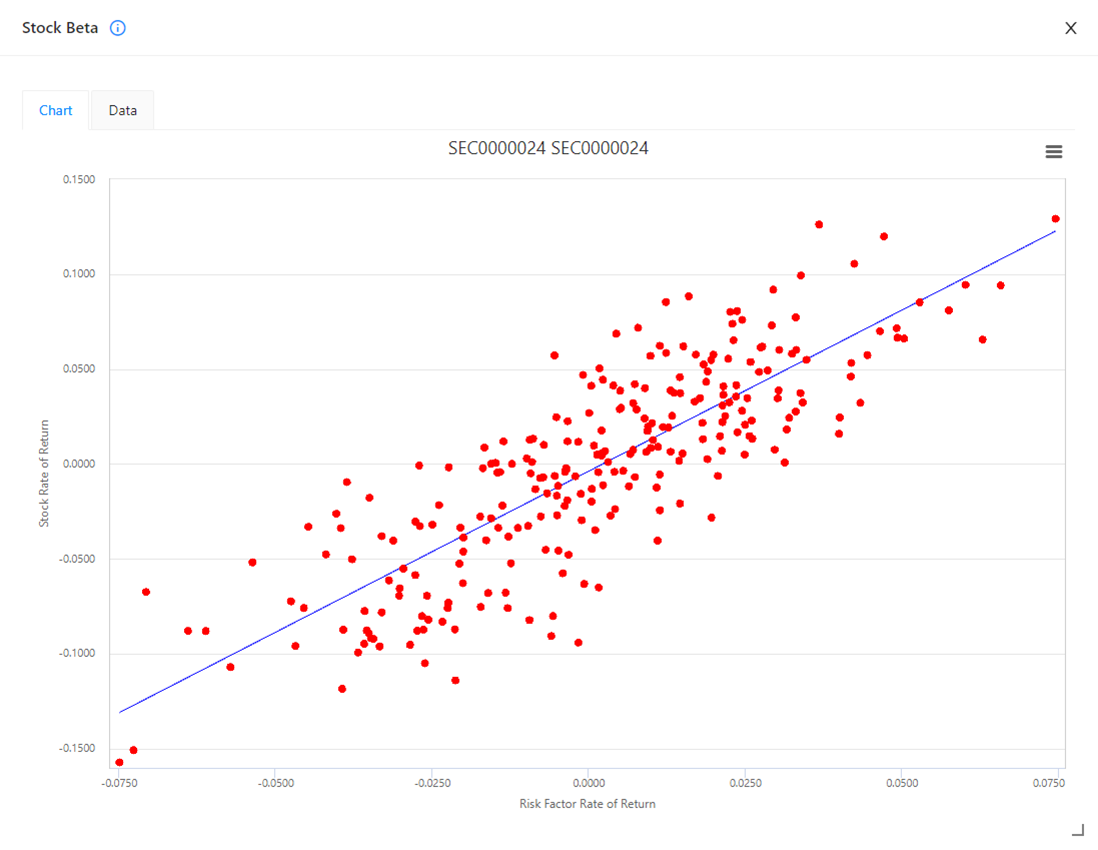

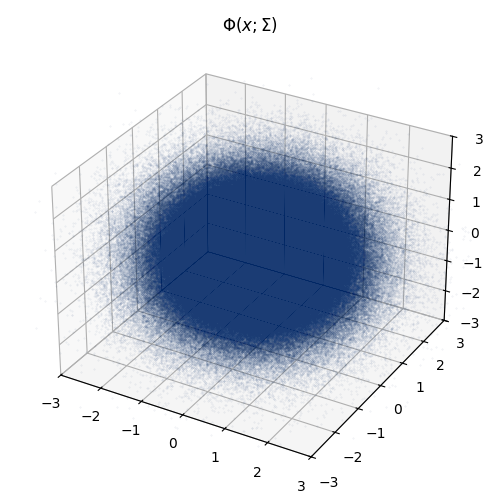

NtSaaS produces well-correlated random numbers (B) based on a set of uniformly distributed random numbers (A) generated using Mersenne Twister.

Technique

Monte Carlo Simulation

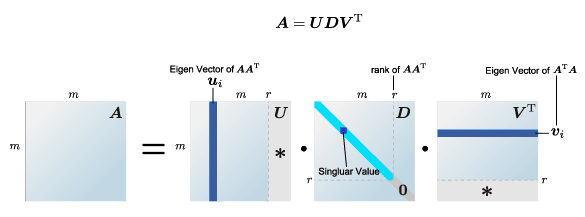

One of the biggest users’ concerns is that actual historical market data may cause mathematical errors when textbookish methodologies, such as Cholesky decomposition, are used. Such errors produce meaningless results and can be hard to identify when using a black-box system.

This can cause risk managers to significantly underestimate VaR. We understand these concerns and provide carefully selected math techniques to handle them.

Singular value decomposition (SVD) is one of the techniques that NtSaaS uses to express real-world requirements in its calculations.